Rare Withdrawal Compounds Market Bearishness

Last week, the EIA produced a whopper. For the week of August 9th, L48 underground natural gas storage fell by 6 Bcf to 3.264 Tcf. This is only the fourth time on record that the EIA reported a summer delivery. The three other deliveries occurred on July 21st, 2006, with a 7 Bcf withdrawal, August 4th, 2006, with a 12 Bcf withdrawal, and July 29th, 2016, with a 6 Bcf withdrawal.

Today, the EIA reported a low injection (addition). Whereas the normal refill for the middle of August is 49 ± 13 Bcf, the EIA reported an injection of 35 Bcf for the week ending August 16th.

This season’s addition inched to 1.040 Tcf, significantly below the seasonal norm of 1.348 Tcf. At this time last year, the injection was 1.253 Tcf, 213 Bcf higher. However, considering that last year’s starting balance was much lower—1.830 Tcf compared to 2.259 Tcf—last year’s injection is 411 Bcf greater on a proportional scale.

Despite this season’s meager pace of refills, the backwardation (premium) on the NYMEX March 2025 Henry Hub futures contract (the final contract of the 2024-25 winter strip) to the April 2025 contract (the first contract of the 2025 summer strip) finished last week at a season-to-date low of +$0.140 per MMBtu!

Backwardations in cross-seasonal spreads only narrow in bear markets!

To this point, per the latest Commitments of Traders Report issued by the CFTC, large speculators in the NYMEX Henry Hub complex liquidated a tremendous amount of gas. Bullish prop desks (Other Reportables) sold the equivalent of 78.8 Bcf of gas, on top of the 137.5 Bcf of gas that bullish hedge funds (Managed Money) unloaded. Large bullish speculators on the NYMEX sold 216 Bcf of gas, which is enough gas to generate 28,768 GWhs of electricity (heat rate 7.5 MMBtu per MWh) and can supply approximately 2.68 million homes annually.

The overall tenor of the natural gas market remains bearish.

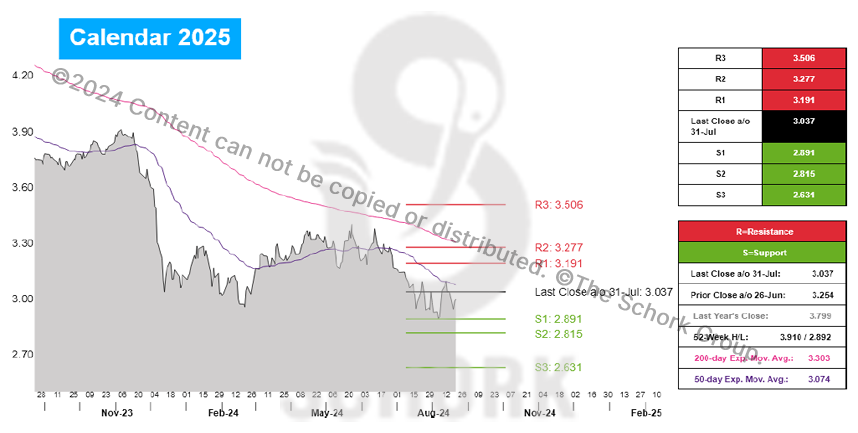

TETCO M3

Cal 2025 gas moved lower in July and finished the month at $3.037. The support targets for August based on this close are $2.891, $2.815, and $2.631. The resistance targets are $3.191, $3.277, and $3.506. The contract finished yesterday at $2.996.

The trend is falling with prices trading below the 200-day ($3.303) and 50-day ($3.074) EMAs. For the remainder of the month, consideration of layering in a hedge position should begin on a retracement to our initial support of $2.891. A break below our second support of $2.815 indicates a good hedging opportunity.

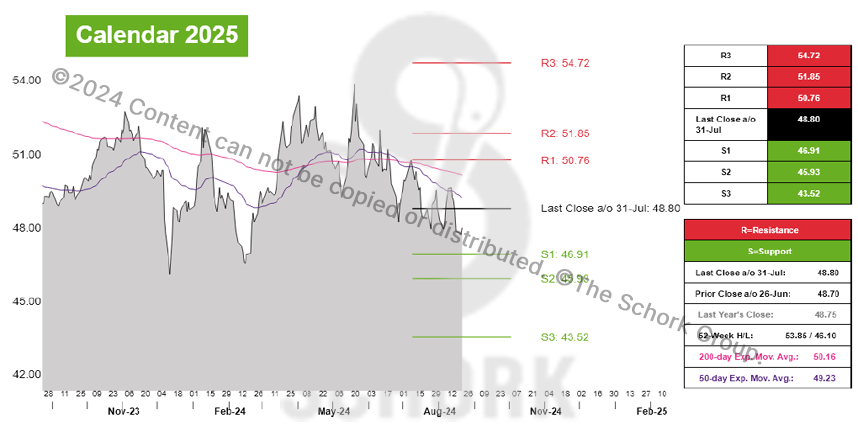

PJM WEST

Cal 2025 RTC power moved lower in July and finished the month at $48.80. The support targets for August based on this close are $46.91, $45.93, and $43.52. The resistance targets are $50.76, $51.85, and $54.72. The contract finished yesterday at $48.00.

The trend is falling with prices trading below the 200-day ($50.16) and 50-day ($49.23) EMAs. For the remainder of the month, consideration of layering in a hedge position should begin on a retracement to our initial support of $46.91. A break below our second support of $45.93 indicates a good hedging opportunity.