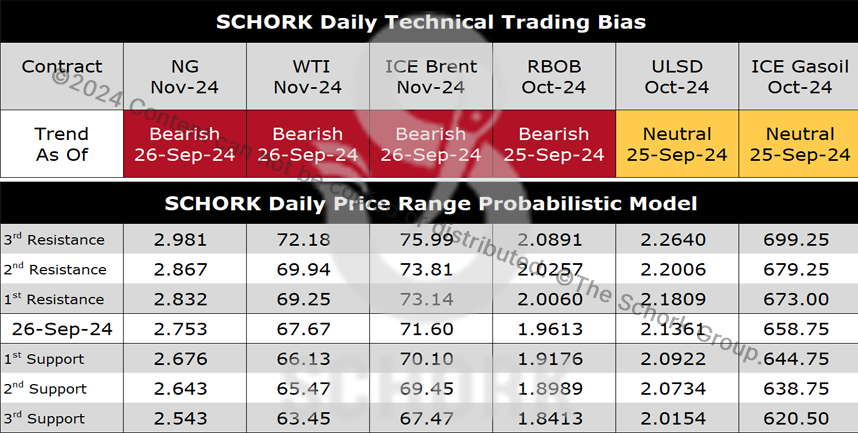

ENERGY PRICES WERE MIXED YESTERDAY… natty rallied as October futures went off the board on a strong note, oil tanked on concerns the Saudis are willing to—for reasons we have yet to fathom why—tank the market.

What We Are Watching

Our model for spot summer natural gas futures on the NYMEX concluded with yesterday’s expiry of the October contract.

As illustrated, on the July 29th expiry of the August contract, gas bottomed within $0.013 of our $1.894, second standard deviation at $1.907. Last month, in the penultimate session of the September contract, the market bottomed within $0.010 of the second standard deviation at $1.904. Therefore, end users were 2-fo-2 in the August and September contracts but whiffed at their final at bat of the season. Over the past week-and-a-half, the October contract rocketed through the first standard deviation of $2.418 and went off the board yesterday at a summer high of $2.753. We will publish our fall gas model next Friday.

EIA Broken Record Redux

Yesterday, the EIA produced another subpar injection (addition) of natural gas to L48 underground natural gas storage. Whereas the normal refill for the middle of September is 83 ± 23 Bcf, the EIA reported an injection of 47 Bcf (net of an 8 Bcf reclassification from working gas to base gas) for the week ending September 20th.

Storage began this refill season at 56% of the historical demonstrated peak working capacity (4.047 Tcf), or 2.259 Tcf. As of last week, storage increased by 1.233 Tcf, reaching 3.492 Tcf, or 86% of working capacity. The end-of-winter balance is typically 1.732 Tcf (43% of working capacity). Based on our modeling, we expect storage to be at 3.376 Tcf (81% of working capacity), implying a 1.545 Tcf injection by this point in the year.

The key takeaway is that although this year’s injection of 1.233 Tcf is 344 Bcf below the seasonal norm in absolute terms, it has achieved a higher capacity utilization. In other words, this year’s injection has been more efficient in terms of capacity usage.