As illustrated, the market sold off sharply last month. On Tuesday, July 2nd, prices broke through our two initial Support targets and finished at $58.50 (B).

The break below our S2 target of $58.92 is significant because 70% of the returns in our model’s 10,000 simulations showed prices moving no lower than this value.

Given the high probability of support for the month, this is a level at which consideration of layering in a hedge should be initiated.

On Wednesday, July 17th, the market bottomed within $0.29 of our S3 target of $55.86, reaching $56.15 (C). This is highly significant, as 95% of the returns from our model’s simulations were priced no lower than $55.86. Consequently, we would strongly recommend establishing a hedge position here.

Yesterday (July 31st), the market bounced back and finished the month at $57.90 (D). The Support and Resistance targets for the August price range forecasts are based on this close and will remain fixed through Wednesday, August 28th.

The next issue of the Power & Natural Gas Report will be published August 22nd. Readers can access interim forecasts throughout the month via the On Demand Tool

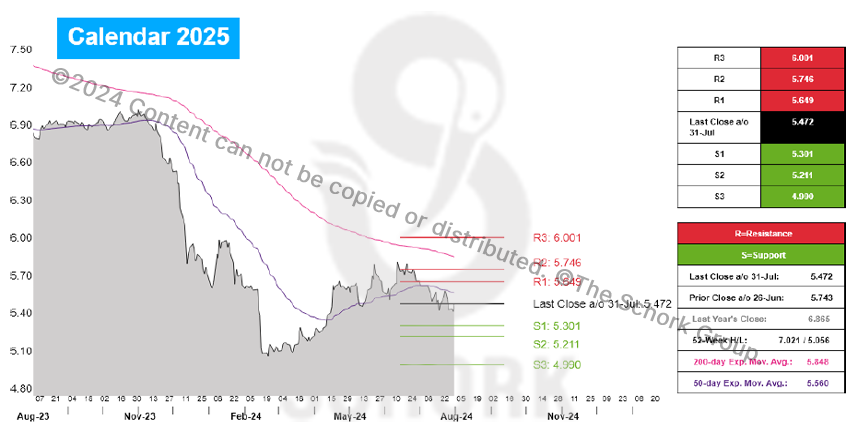

Algonquin citygate

Cal 2025 gas moved lower in July and finished the month at yesterday’s close of $5.472. The new support targets for August based on this close are $5.301, $5.211, and $4.990. The new resistance targets are $5.649, $5.746, and $6.001.

The trend is lower with prices trading below the 200-day ($5.848) and 50-day ($5.560) EMAs. For the month ahead, consideration of layering in a hedge position should begin on a retracement to our initial support of $5.301. A break below our second support of $5.211 indicates a good hedging opportunity.

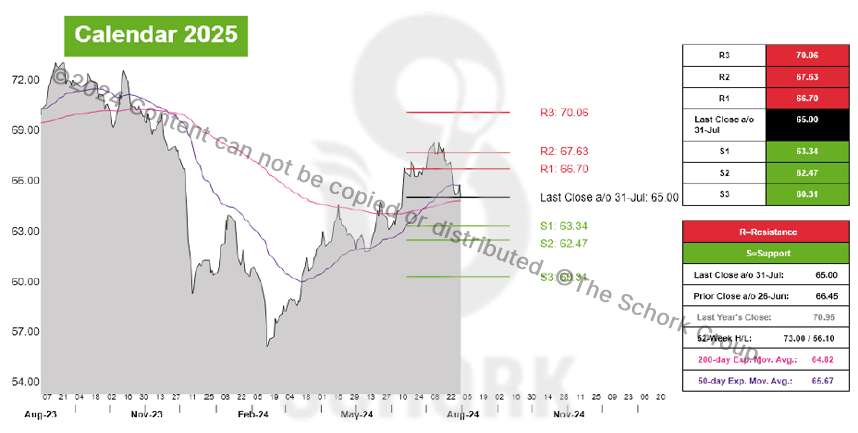

ISO NEW ENGLAND

Cal 2025 RTC power moved lower through July and finished the month at yesterday’s close of $65.00. The new support targets for August based on this close are $63.34, $62.47, and $60.31. The new resistance targets are $66.70, $67.63, and $70.06.

The trend is flat with prices trading between 200-day ($64.82) and 50-day ($65.67) EMAs. For the week ahead, consideration of layering in a hedge position should begin on a retracement to our initial support of $63.34. A break below our second support of $62.47 indicates a good hedging opportunity.