ENERGY PRICES WERE MIXED LAST WEEK… natty surged on the roll from October (the final contract of the 2024 summer strip) to November (the first contract of the 2024-25 winter strip). Oil tanked as OPEC maintained a dovish stance.

What We Are Watching

In the latest CFTC Commitments of Traders report through Tuesday, September 24th, the number of bullish natural gas hedge funds (Managed Money) in the NYMEX and ICE markets rose by 4 to 84, while the number of bears plunged by 16 to 68.

In the process, the number of longs fell from 4,263 contracts for every trader to 4,067 contracts. At the same time, the number of bearish fund managers fell from 84 to 68 but, the number of shorts per fun rose from 3,389 to 3,829.

The bottom line in the two largest natural gas futures markets is the number of bullish hedge funds rose from 80 to 84 while the number of longs fell from an average of 4,263 contracts to 4,067 contracts. On the opposite side of the trader’s number line, bearish funds plunged by 16 to 68 and the average short per trader fell from 4,067 contracts to 3,829.

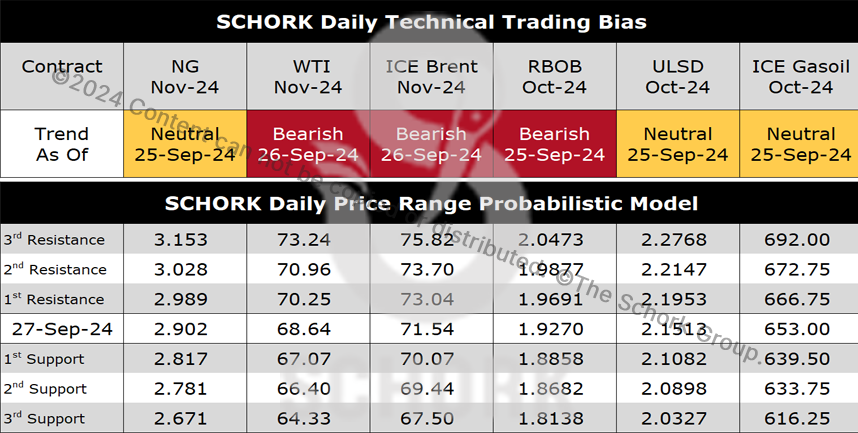

On Friday, November gas bottomed at $2.720 (arrow 1), peaked at $2.932 (arrow 2), and settled at $2.902, up $0.149 on the day (arrow 3).