Energy Quotient

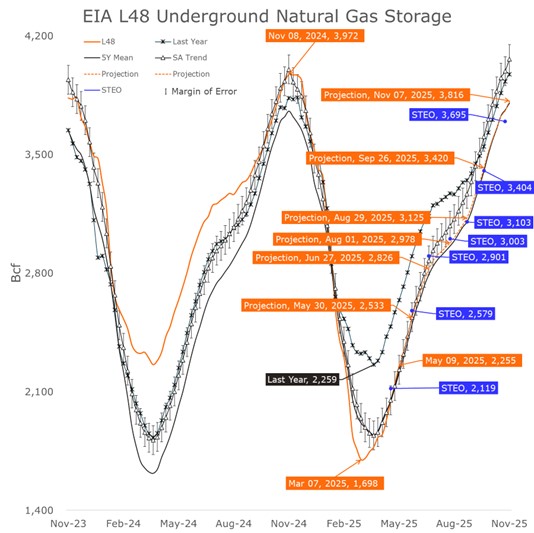

The U.S. natural gas market added another record-setting injection to underground storage last week, with the EIA reporting a 110 Bcf build — pushing the three-week total to 321 Bcf, the earliest such streak of 99+ Bcf injections on record. Lower 48 storage now stands at 2.255 Tcf, up 557 Bcf on the season, trailing only the Covid-handicapped summer of 2020. At this pace, inventories remain on track to reach 3.816 Tcf by the start of winter.

Despite the continued strength in injections, NYMEX futures rose 4.9% last week to $3.660, supported in part by firming regional basis and subtle shifts in positioning. Despite the continued strength in injections, NYMEX futures rose 4.9% last week to $3.660, supported in part by firming regional basis and subtle shifts in positioning.

Houston Ship Channel (HSC) basis narrowed by 5.2% to –$0.342, lifting the implied price by 6.0% to $3.318. However, Producer/Consumer net length fell 12.5% to a three-month low of 132,028 contracts, indicating further monetization of length. Meanwhile, Swap Dealer net length jumped 186% to a two-month high, reflecting a shift in hedging flow — a reversal from the net short posture seen just a month ago.

Texas Gas Zone 1 (TGT Z1) basis tightened by 10.1% to –$0.252, lifting the implied price 6.2% to $3.408. Producer/Consumer length continued to erode, down 8.4% to a three-month low of 106,977 contracts. Meanwhile, Swap Dealers trimmed their net short position by 7% to a year-to-date low of 105,602 contracts — a move that likely reflects modest end-user hedging or broader risk reallocation.

In effect, the modest reduction in Swap Dealer shorts — alongside basis strength and weakening producer length — suggests that end-users may be quietly stepping in. Not in size, but enough to hedge against further narrowing or potential price volatility.

Transco Zone 4 Station 85 basis narrowed by 19.4% to +$0.360, but the strength masks cautious behavior among commercial players. Producer/Consumer net shorts surged 19.5% to a YTD high of 62,772 contracts, likely reflecting proactive hedging ahead of seasonal supply pressure. Swap Dealer net shorts eased modestly but remain elevated.

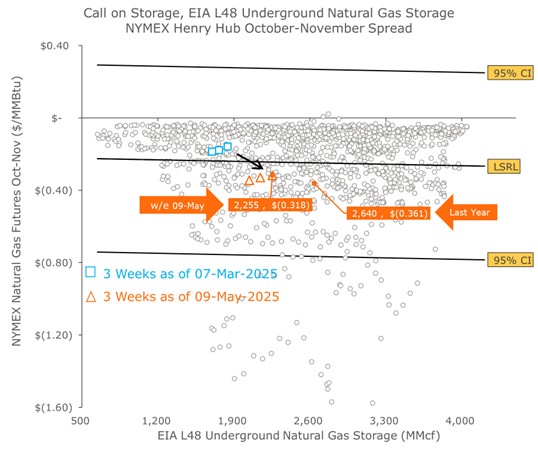

The October–November 2025 contango narrowed slightly to –$0.318, but the 3-week average remains below the historical regression to storage, pointing to persistent oversupply sentiment into the fall shoulder season.

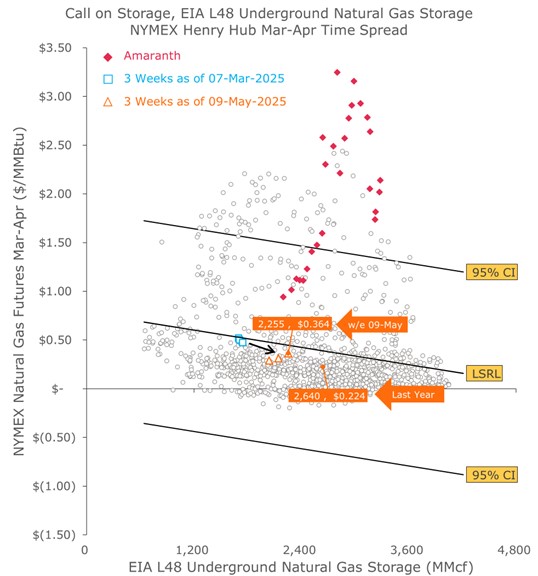

The March–April 2026 backwardation widened to +$0.364, a five-week high, but the 3-week average has also slipped below its storage-aligned LSRL, suggesting weakening confidence in late-winter tightness.

Storage fundamentals remain dominant, but regional basis and positioning tell a more nuanced story. Basis continues to firm across major trading hubs, supporting stronger spot prices, but commercial players — particularly producers — are rotating out of length and adding short exposure, especially in the Southeast. This reflects growing caution amid strong early-season injections and the potential for pipeline congestion or storage saturation later this summer.

The NYMEX curve (see above), while firmer in the front, still reflects structural concerns, particularly in cross-seasonal spreads. For now, physical markets are firm, but forward sentiment is hedged — literally and figuratively.

The NYMEX curve (see above), while firmer in the front, still reflects structural concerns, particularly in cross-seasonal spreads. For now, physical markets are firm, but forward sentiment is hedged — literally and figuratively.

The Schork Group has established a niche as the benchmark for objective insight—delivering energy market intelligence through a neutral lens. In today’s data-saturated environment, markets are noisy—and readers rely on us to cut through the clutter, identify what truly moves prices, and deliver direct signals to manage risk. Learn more about our products and services: www.schorkgroup.com.